How To Make A Trading App And How Much It Costs

Содержание

To avoid problems, you need to choose a software solution provider carefully. Only then can you reach a high level of return, security, and user satisfaction, with a resulting application that takes your business to a fundamentally new level. Built around proprietary trading techniques that institutional traders use every day, our tools are lightning fast and supremely effective. A platform built around gaining a true edge in the markets, trading data is presented exactly as you need it with no gimmicks.

- High Frequency Trading is a subset of algorithmic trading that involves buying and selling small deal sizes in a very short amount of time.

- This is what 99% of people need from their charting “with as few clicks as possible”.

- Electronic trading platforms also commonly provide Application Programming Interfaces that allow users to execute trades, view current and historical data, and evaluate trading performance.

- If only your market is lively but the other 2 quiet, it’s more likely any move will soon fade.

- The most obvious use of this is to see the change in trading activity at key inflection points (e.g. support & resistance levels) in the market.

- Many platforms provide APIs that allow users to place orders directly from their code.

Another feature commonly found on trading platforms is the ability to track the user’s portfolio, and this can influence trades based on how a trader has been performing. For example, E-Trade displays the assets included in a user’s portfolio, and compares them to sample portfolios. With investors not needing to visit a floor exchange such as the NYSE, trade execution over longer-range networks has caused discrepancies in trading speed. The travel of data over the Internet, incurring many network switches, also brings on additional time delays.

Considering this, the full price of a stock trading app can be either US$25,000 or US$300,000. On average, the total cost of developing a stock trading mobile application is US$55,000. Decimalization was instituted in 2001 by the SEC, requiring market makers to value financial instruments by increments of $0.01 as opposed to the previous standard of $.0625. This change significantly lowered margins, providing an incentive for big dealers to utilize electronic management systems, and eventually lead to lowered trading costs.

QA engineers conduct complex testing across platforms and devices to establish the correct performance. After placing the app in stores, you have to ensure technical support, troubleshooting, and regular updates. Paid admission to technology tools, such as application programming interfaces . This website is using a security service to protect itself from online attacks.

We added traditional charts to our Order Flow package in response to tightening of regulations by the CME that sees your data fees increase dramatically if you connect from 3 or more apps. This is a charting tool for traders, it is not meant to be a huge and complex tool with thousands of options per chart and indicator. That’s been done elsewhere and we aren’t trying to do what everyone else is doing or compete with “tools you tinker with forever”. This is what 99% of people need from their charting “with as few clicks as possible”.

Which Platform To Choose Flutter Or React

Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. The most obvious use of this is to see the change in trading activity at key inflection points (e.g. support & resistance levels) in the market.

Ethereum Proof-of-Work Pool Goes Live Through Binance Pool – CryptoNewsZ

Ethereum Proof-of-Work Pool Goes Live Through Binance Pool.

Posted: Mon, 03 Oct 2022 10:03:24 GMT [source]

With the development of electronic trading platforms, the bar to entering algorithmic trading has been vastly lowered. Many platforms provide APIs that allow users to place orders directly from their code. These platforms also typically provide methods for algorithm designers to obtain market data. For example, the trading platform Interactive Brokers provides an API for users to obtain market data and place trades from within custom programs.

Historic Development

Less obvious uses are in helping to gauge the strength of a pullback, the chances of a market breaking out and in trade management. These are all uses of the pace of trade used by institutional day traders every day. Development costs are determined by the solution’s complexity, features set, and additional factors, such as connecting payment gateways and cloud services.

For many traders, you can click by their name to see the trades along with the SIM/Live designation. Large Trade Circles– our proprietary algorithm, reveals areas of high volume that trade at a level over time. Time and time again, these circles pinpoint key areas such as the end of a volume blow off, iceberg orders and market turning points.

Jigsaw Daytradr

That’s because most platforms take an optimistic view on the prices you’d be filled at. Jigsaw daytradr is different – it gives you realistic fills on Limit Orders and realistic slippage on Market and Stop Orders. Daytradr contains all the features from the popular plug-in and IQFeed. Daytradr contains all the features from the popular plug-in from Jigsaw and much more, to deliver a truly flawless trading experience. One of the most famous controversies involved the GameStop short squeeze, where thousands of retail investors attempted to short squeeze the GameStop stock. Due to alleged concern about the harms of short-term volatility, Robinhood halted the purchase of the GameStop stock.

It is here we see the interaction between passive traders and active traders . Regardless of how you will make decisions longer term , spending time doing drills on our DOM will pay off huge dividends in terms of your market understanding. Our award winning tools can integrate to your existing trading platform. The Jigsaw Platform Bridge™ allows daytradr to connect directly with the NinjaTrader 7/8 and MetaTrader 5 platforms as well as MultiCharts.NET and MultiCharts.NET SE.

Tools

Barclays and Credit Suisse were fined $154M in 2014 for allowing high-frequency traders to exploit the dark pool exchanges on their trading platform. Credit Suisse ended up paying $24.3 million in disgorgement to repay losses. Trading platforms often provide current news to inform users’ decisions of their trades. This can include articles on specific companies, or updated ratings given by independent firms specializing in certain commodities. On some applications, this specialized news allows retail traders to have access to the same information their professional counterparts. Notably, Robinhood features market news for their assets, and sends push notifications close to earning events.

Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success. A slightly different use but equally beneficial is monitoring the pace of correlated markets. For example, if S&P, Nasdaq and DOW Futures are all lively – you have more chance of follow through. If only your market is lively but the other 2 quiet, it’s more likely any move will soon fade.

Algorithmic Trading

Some popular electronic trading platforms today use a simple interface to minimize trading friction. For example, Robinhood uses a “minimalist” interface and straightforward colors such as green and red to indicate profit/loss. In addition, as described by Robinhood’s UI designer, the use of a familiar swipe up gesture to execute trades further reduces trading friction.

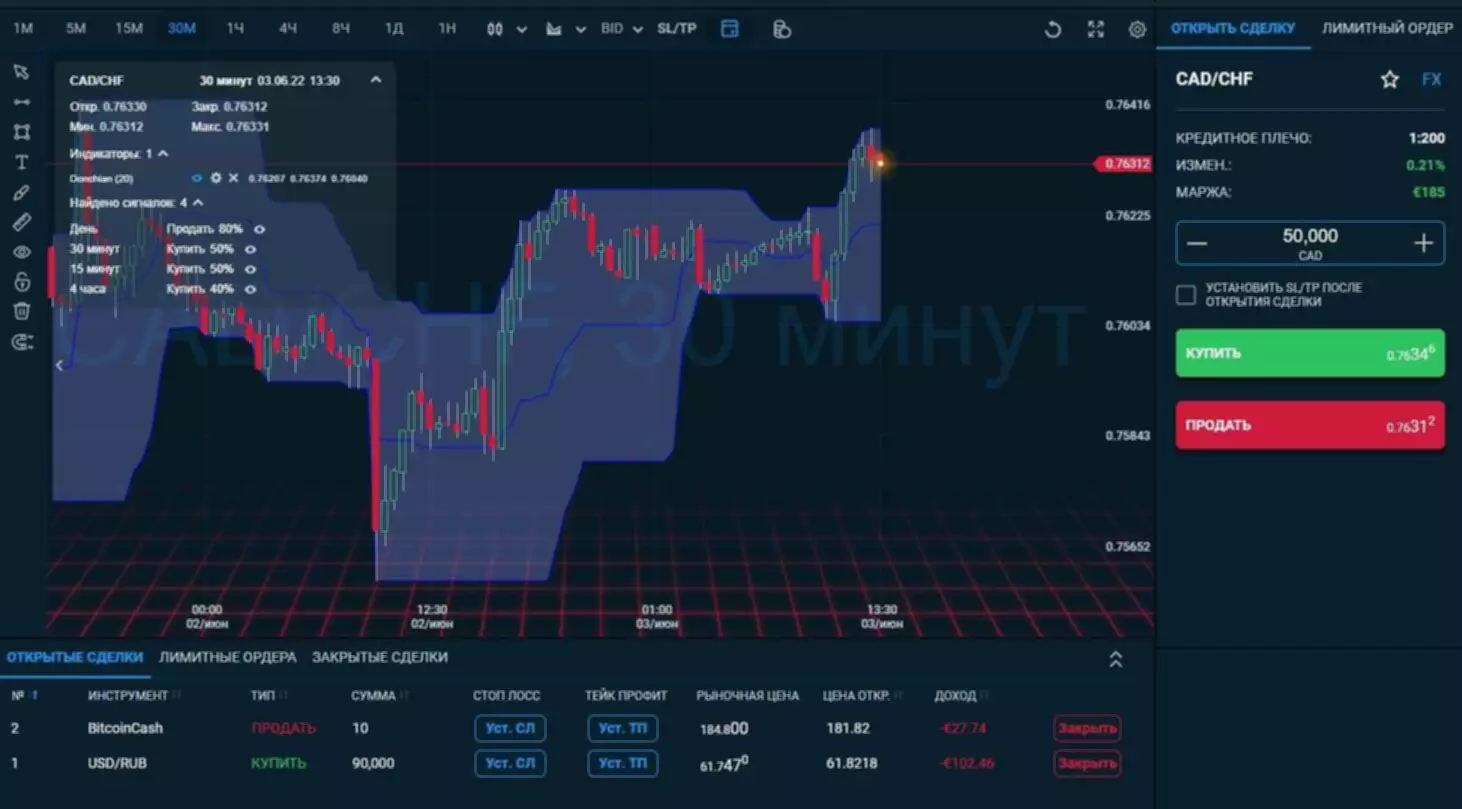

Electronic trading platforms also commonly provide Application Programming Interfaces that allow users to execute trades, view current and historical data, and evaluate trading performance. A stock market app is an online system designed to make it easier to buy and sell on trading platforms, manage and update investment portfolios, and choose strategies. Automated trading systems allow users to have things under control the whole time and are suitable for long-term investments or short-term deals. So-called DIY (do-it-yourself) investment via smartphone applications is becoming more popular. Our article will examine how these systems work and generate income for the owner and what it will cost to create a stock trading app. Dark poolsare private exchanges for trading commodities such as stocks and bonds that are not accessible to the public, and offer secrecy surrounding trade execution.

As price approaches, we look for front running by other trader or for the liquidity to be pulled out of the way. The idea of a product is validated and turned into a business model and development roadmap.Experts collect all the info to define the app’s features, design strategy, and line-up. Protect users and their money via multifactor authentication, https://xcritical.com/ 256-bit AES encryption, AI-based fraud prevention, and other security tools. The system charges interest on deposits, user transactions, and stock transactions. Essential product features are free for all users, but additional ones are available for a fee. Note that the Jigsaw Leaderboard contains a mixture of SIM/Live Traders.

The trade of a stock closer to market central computers in the NYC area executes 2.8% faster than one outside of the NYC area. A trade in the NYC area experiences a bid-ask spread 0.75 cents lower than one outside NYC, reducing aggregated costs significantly. Learning to trade or learning a new strategy is problematic on most trade platforms. Unless you are trading live, with real money – you’ll never know how realistic the results are.

Securities and Exchange Commission promulgated Rule 17a-23, which required any registered automated trading platform to report information including participants, orders, and trades every quarter. Requiring platforms to comply with enhanced pre- and post-trade transparency requirements has provided a stronger incentive for users to trust electronic trading platforms. High Frequency Trading is a subset of algorithmic trading that involves buying and selling small deal sizes in a very short amount of time. Traders attempt to make money through short term predictions, arbitrage across different markets, or market making. These strategies naturally benefit from low latency and low execution time; as a result, firms must develop and continually update their own custom trading platforms.

Auction Vista gives a detailed view of both real time and historical order flow. An extremely accurate ‘self tuning’ view with very few settings required to get the most from it. A tool that is the cornerstone of the proprietary trader’s decision making process.

The time cost needs to be adjusted for the developers’ hourly rate, which varies from US$15–20 to US$100 or more. The SEC indicted the cofounder and current CEO of Ripple Labs, Inc. for raising over 1.3 billion dollars through the sale of the digital asset XRP in an unregistered securities offering. Developers consider the mobile app’s platform, managed cloud services, third-party APIs for core and non-core features, and other crucial tools. So whether you are learning to trade OR trying out a new strategy, the Jigsaw Trade Simulator gives you a much more realistic set of results. Market Depth visualization– the shaded background contains lighter areas show us where liquidity exists. This is not a guarantee of the market holding but a heads up that other traders are interested in that area.

Depth & Sales Depth Of Market

There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. The Pace of Tape Smart Gauge comes in over 50 styles and gives you an easy to absorb view of the pace of trading in a market relative to recent historical average. Find out more about trading app development and its cost in our full article. Designers must think over the line and bar charts, stochastic oscillators, candlesticks, and other graphs. The electronic cryptocurrency exchange Binance has been under investigation by the U.S. in 2021 for money-laundering and tax evasion.

The DOJ and IRS believe that Ripple used Binance to finance illegal international activities. There’s too many great features to list that aren’t on this page but for the really curious, you can take a look at the product XCritical: Uninterrupted and fast trading platform work manual. We started with “LTF” – Lower Time Frames – or those below the daily timeframe. Notifications and newsfeed that help to keep investors informed of exchange rates, initial public offerings , and other details.

How Much Does It Cost To Build A Stock Trading App: A Development Guide

Alpaca is another popular platform specifically designed for algorithmic trading that offers clear documentation for a variety of languages and provide testing functionality in their API. An electronic trading platform is a piece of computer software that allows users to place orders for financial products over a network with afinancial intermediary. These products include stocks, bonds, currencies, commodities, and derivatives. The availability of such trading platforms to the public has encouraged a surge in retail investing.

Market fragmentation led some Nasdaq market makers on Instinet to quote prices that were better than their own quotes on Nasdaq. To address this discrepancy, the SEC introduced the Order Handling Rules in 1996. Another Order Handling Rule required a market maker to display the size and price of any customer limit order that either increased size at the quoted price or improved the market maker’s quotation.