Forex Trading Canada 2022 ️ Best Forex Brokers

Contents

The potential for gains is enhanced if the currency you’re betting against falls in value. On the downside, you will magnify your losses if the currency you traded against value increases. As you can see, your risk of losing is multiplied when you employ a leveraging strategy because you are investing money you don’t actually own. A country’s underlying economic performance can affect the price of its dollar.

He identified a need in Canada for a company specializing in currency exchange that could address the needs of real people and real businesses. He teamed up with a currency specialist and soon thereafter Interchange Financial was born. Perhaps not surprisingly given the demand for better exchange rates, we have grown into one of Canada’s premier currency exchange specialists. It is essential that your forex broker offers the trading platform you want to use. The table above the trading platforms offered by the different forex brokers.

Friedberg Direct offers a selection of trading platforms, for manual trading, with unique features and tools to optimize your trading experience. Our selection caters to all traders, where you are sure to find the one which best suits you. In addition to spot trades, our platform allows FX options trading. Due to the increasing interest in forex trading, the number of brokers in Canada has also increased in recent years. Not all providers are similar when it comes to trading offers, conditions, and other services. In addition, every trader has his own needs and techniques.

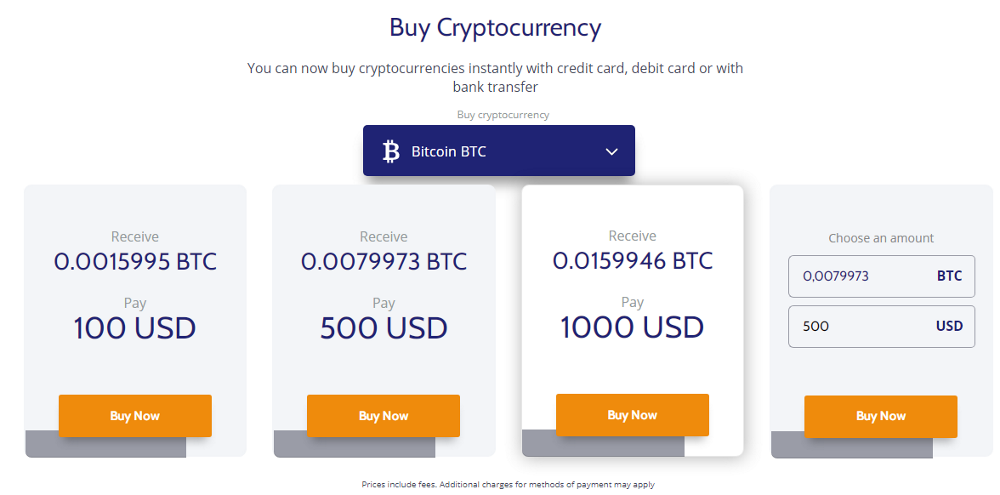

Using the above example, if the USD/CAD exchange rate is 1.2, it will cost C$1.20 to buy US$1.00. If the USD/CAD exchange rate rises to 1.3 it means that the base currency has risen in value compared to the quote currency . If you bought it at 1.2 and sold it at 1.3 you will have made a profit, and that is how forex trading works. Both cryptocurrencies and CFDs are complex leveraged instruments with a high level of risk. You should carefully consider whether you understand how these financial instruments operate and whether you can afford to lose money.

Trade with Confidence and Benefit from

As an investor, I have traded both shares and share CFDs in my own capacity. Perhaps like you, I just wanted to trade the “real thing” and avoid what I saw as unnecessary complexity. Compare the best Islamic trading accounts in Canada, including standalone Islamic accounts and others available without swap charges. Finding a Shariah-compliant trading account is harder than it sounds. We’ve reviewed 8 brokers with Islamic accounts, and called out TrustedBrokers’ “Best Islamic Broker in 2022”. If you live in Iran and are looking to trade CFDs on Forex, stocks or even crypto-currencies, you can open an account with HYCM (HYCM.com). Their service is available in English and in Farsi.

Some brokers accept small deposits like $50, while others will not accept anything below $500 to activate your trading account. For active accounts, some brokers accept deposits of $5 or $10, while others demand more to top up your trading account. Forex trading in Canada is a zero sum game, meaning that for a trader to gain, another must lose. Even the most experienced forex traders in the world suffer substantial losses when the market is volatile.

- This often includes international stock trading, stock indices, index funds, precious metals, agricultural commodities, and much more.

- You should carefully consider whether you understand how these financial instruments operate and whether you can afford to lose money.

- Forex trading is a legal endeavor, but that doesn’t mean that every broker follows the letter of the law.

- This page contains all the information you need about forex trading in Canada.

- It is often far more convenient, both technologically and monetarily, to have your money and platforms with the same broker.

There are many currencies that are traded daily in the forex market. Each currency is paired with another to make a currency pair. When trading Forex, you are buying one currency by using another. Therefore, the forex trader is trading currency pairs and not each currency individually.

Account Manager (Mandarin)

On a personal note, we’ve been consistently impressed by the quality of its customer service, available 24/7 in over 12 languages. Martin Jekic has been dealing with the stock exchange and active investments for over 10 years. After completing his studies and spending some time in banking, he turned his hobby into a profession. It is particularly important for him to pass on his experience and tips to both beginners and advanced investors and to make the investment market for Forex, stocks and CFDs more transparent. The laws existing in Canada state that brokers can operate in the country without obtaining any regulatory license. Be that as it may, a broker will enjoy several benefits if it gets regulated and holds a regulatory license in Canada.

The term forex comes from the words ‘foreign currency’ and ‘exchange’, and involves converting funds from one currency to another. In other words, whenever a foreign currency is exchanged, it can be considered a forex transaction. We have exchange rates that are much better than the banks and we charge no fees. When placing your money with a broker, you need to make sure your broker is secure and can endure through good and bad times. Our strong capital position, conservative balance sheet and automated risk controls are designed to protect IBKR and our clients from large trading losses. National Bank Direct Brokerage’s interest rates for margin accounts depends on your debit balance.

Start trading

The spot forex market (on-the-spot) is the most common type of foreign exchange market. It involves a buyer and a seller negotiating a trade at a specified price. This price is determined by several underlying factors, including economic conditions, global events, and investor emotion.

Your FOREX.com account gives you access to our full suite of downloadable, web, and mobile apps. I understand that residents of my country are not be eligible to apply for an account with this FOREX.com offering, but I would like to continue. We’re sorry, but the service you are attempting to access is not intended for residents of your country. Build your confidence and knowledge with a wealth of educational tools and online resources.

You don’t want to be irritated with the platform every day because it is underperforming. Investing.com has done all the hard work for you, comparing the top brokers for reliability, speed and fees. Browse our carefully-crafted reviews to find the best Forex broker for your needs. These charges may not amount to much, but over a period of time, they may eat into your profit or trading balance.

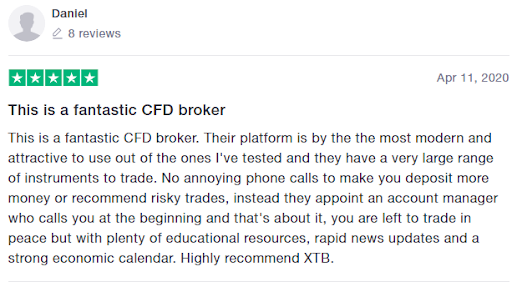

If customer support is poor, you should never register with such a broker. It does not matter if the broker offers all the best trading tools in the world. It also does not matter if the trading platform looks attractive. None of these things are as important as top-quality customer service.

The timing and hassle-free nature of deposits and withdrawals is an important facet of a broker. Forex is a fast-paced trading environment, and you can’t wait around for weeks for a deposit to clear. Fortrade has a lot canadian forex brokers of educational and analytical tools to offer its clients, as well as a wide range of CFDs to buy and sell. An unlicensed broker is a red flag because they may close up shop at any moment and run away with your money.

How to Open Forex Trading Account

FX traders in Canada should sign up with forex brokers with the Canadian dollar as an account base currency. This reduces the cost of trading and https://broker-review.org/ currency conversion fees. The spread in forex refers to the difference between the bid rate and the ask rate for a specific currency pair.

Forward Forex Market

CFDs are incredibly complex and come with a high risk of losing money due to the nature of leverage. It is estimated that 65% of retail investor accounts lose money when trading CFDs. Forex traders use the forex market to try and make a profit by speculating on the fluctuating exchange rate of currency pairs. When you’re trading a currency pair, that risk is sometimes amplified.